Users can access the PFMS portal login for securing transparent financial transaction management in government operations. The PFMS portal enables easy and effective finance management which allows all users such as agency officials and bank staff and beneficiaries to track budgets and expenses and electronic payments in transparent ways.

The Indian Ministry of Finance established PFMS as a public financial management system in 2009 to achieve efficient public fund control. The system grants viewing access of current financial details to Persons and Beneficiaries and Banks thus providing both transparency and accountability for financial dealings.

What is PFMS Portal Login?

PFMS Portal Login is nothing but a portal through which the authorized user is given secure access to the Public Financial Management System. It smoothes out cumbersome financial transactions while allowing for effective and secure management of the financial data. Through this portal, budgets, payments, and audits can be handled securely.

When it comes to real-time tracking of finances, the PFMS portal login allows seamless access to accurate financial data. It ensures data integrity as access to this sensitive financial information is denied to unauthorized personnel.

Benefits of Using PFMS Portal Login

Using this system offers multiple important advantages. It automates financial tasks, significantly reducing human errors. With instant access to current financial data, users gain precise insights to manage finances effectively.

| Benefit | Description |

| Enhanced Accuracy | Reduces manual errors by automating processes |

| Increased Efficiency | Quick access to real-time financial information |

| Simplified Compliance | Easy audits and transparent transactions |

| Secure Transactions | Reliable electronic payment processing |

Adopting this system provides secure, efficient, and transparent financial operations. Regular use ensures consistent compliance and minimizes potential financial discrepancies, keeping your finances organized.

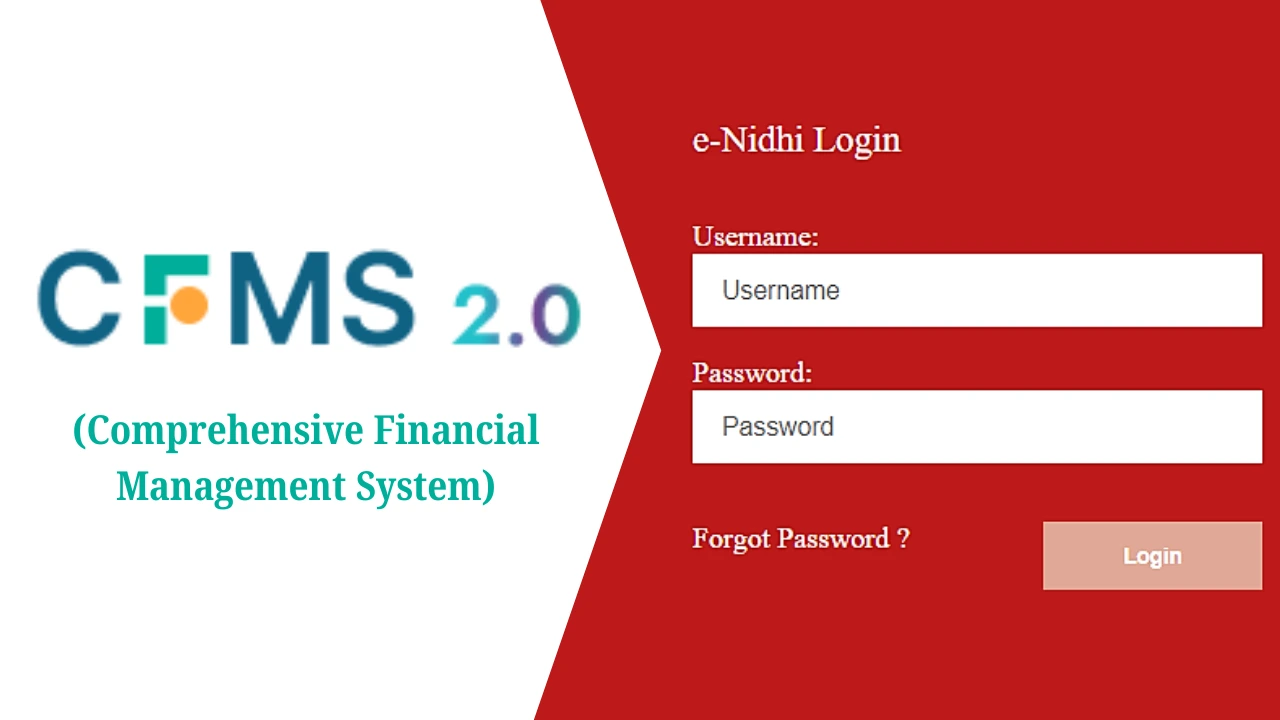

How to Perform PFMS Portal Login

Understanding how to log into the portal correctly is crucial. Proper login ensures secure access to your financial data. Follow the steps below to successfully log in and manage your financial tasks.

Step 1: Access the Official Website

Open your web browser. Type the official website PFMS URL. Ensure the website is secure by checking the URL and security certificates. Always use the official site to avoid scams or data breaches.

Step 2: Choose the Financial Year

Select the appropriate financial year from the dropdown menu. This ensures you access the correct period for your transactions. Incorrect selection may lead to confusion and data inaccuracies.

Step 3: Enter Credentials

Carefully enter your username and password. Double-check to avoid typing errors. Accurate credentials ensure smooth and uninterrupted access to your account.

Step 4: Complete Captcha Verification

Fill in the captcha exactly as shown on the screen. Captcha ensures only genuine users can access the portal. Incorrect entries may require repeated attempts.

Step 5: Submit Your Login

Click the “Submit” button. Wait for the system to verify your information. After verification, your account dashboard appears, giving you access to financial management features.

Step-by-Step PFMS Portal Login Registration Process

Before logging into the portal, users must register. Accurate registration ensures smooth future access. Below are detailed steps tailored for different user types.

Step 1: Identify User Type

Decide if you are registering as an agency or an MIS user/DBT beneficiary. Each type has a specific registration process. Correct identification ensures proper form filling and access.

Step 2: Fill Out Required Information

Complete the registration form accurately. Include your email, unique user ID, and account details. Errors in this step could delay your registration approval.

Step 3: Create a Secure Login ID and Password

Choose a strong and unique login ID. Develop a robust password combining letters, numbers, and special characters. Strong credentials protect your account from unauthorized access.

Step 4: Answer Security Questions

Select and answer security questions clearly. This step helps recover your account if you forget your login details. Provide memorable yet secure answers.

Step 5: Complete Captcha and Submit

Enter the captcha verification precisely as displayed. Review your form before clicking submit. Upon successful submission, you will receive confirmation for portal access.

Importance of Digital Signature in PFMS Portal Login

Digital signatures are crucial when using PFMS portal login. They verify the identity of users, making transactions secure and legally binding. DSC enhances security, protecting sensitive financial data from unauthorized access.

1. Secure Authentication: Secure authentication ensures only authorized personnel access financial data. Digital signatures validate user identities accurately. They significantly reduce the risk of unauthorized access or fraud. Proper authentication safeguards financial information effectively.

2. Legal Compliance: Digital signatures fulfill legal compliance requirements. They provide legal validity similar to handwritten signatures. Documents signed digitally hold strong legal standing. This compliance simplifies audits and regulatory processes.

3. Data Integrity: Data integrity ensures the accuracy and consistency of financial records. Digital signatures detect unauthorized modifications immediately. They guarantee that data remains unchanged from the point of signing. This protects financial documents from tampering.

4. Efficiency in Transactions: Digital signatures speed up financial transactions. They eliminate the need for physical documents, reducing delays. Faster transaction approvals improve overall productivity. Digital signing streamlines workflows significantly.

Obtaining a Digital Signature for PFMS Portal Login

Digital signatures enhance security and legality in financial transactions. Obtaining a digital signature is a straightforward process but essential for secure operations.

Step 1: Visit Certifying Authority Website

Go to an authorized certifying authority website. Check for proper licensing and certification details. Authentic providers ensure valid and accepted digital signatures.

Step 2: Select Digital Signature Type

Decide between different signature types based on your needs. Choose Class 2 for regular transactions or Class 3 for more secure and high-level tasks. Ensure the choice matches your operational requirements.

Step 3: Hardware Token Decision

Decide whether you need a hardware token. Hardware tokens enhance security but require additional management. Consider your convenience and security level required.

Step 4: Provide Personal Information

Clearly fill out personal details including your name, contact number, and address. Accurate information is necessary for successful verification and issuance of the digital signature.

Step 5: OTP Verification

Verify your mobile number by entering the OTP received. OTP verification confirms your identity. This step is crucial to validate your request securely.

Step 6: Finalize Digital Signature Enrollment

Submit your details after careful review. You will receive confirmation once your digital signature enrollment is successful. This final step ensures your readiness for secure electronic transactions.

How to Enroll Digital Signature in PFMS Portal Login

Enrolling a digital signature helps secure and verify your transactions. Follow these clear steps for successful enrollment:

Step 1: Log into Your Account

Begin by logging into your PFMS account. Use your verified login details. Make sure to enter your credentials correctly to avoid issues.

Step 2: Navigate to DSC Management

After logging in, go to the main menu. Click on the “Masters” tab. Choose “DSC Management” to access digital signature enrollment options.

Step 3: Start Digital Signature Enrollment

Next, select the option labeled “Enroll DSC.” A list of available certificates appears. Pick the correct certificate carefully.

Step 4: Select Certificate and Enter PIN

Choose your digital certificate from the displayed list. Enter the associated PIN accurately. Confirm your choice to proceed.

Step 5: Confirm Successful Enrollment

After entering your PIN, wait briefly. A message confirms successful enrollment. Ensure you receive this confirmation before moving on.

Step 6: Verify and Complete Enrollment

Finally, review the displayed details carefully. Confirm everything is correct. Complete your digital signature enrollment process by clicking “OK.”

Checking Payment Status through PFMS Portal Login

Monitoring payment status is simple if you follow clear steps. Here’s how you can easily verify your payments:

Step 1: Log into Your Account

Start by logging into your PFMS account with accurate credentials. Proper login ensures secure and quick access. Double-check details before submitting.

Step 2: Go to Payment Status Section

After logging in, navigate to the “Payment Status” section. It’s clearly marked in the user menu. Click to enter the section.

Step 3: Provide Bank Details

Enter the first few letters of your bank’s name. Provide your accurate bank account number twice. Double-check to avoid mistakes.

Step 4: Complete Verification

Carefully type the captcha characters displayed. Accuracy here ensures successful verification. Mistakes could delay the process.

Step 5: Confirm OTP

Click “Send OTP” to your registered mobile number. Enter the OTP accurately when received. OTP verification secures your data.

Step 6: View Your Payment Status

After OTP confirmation, your payment status appears clearly. Review details carefully. Make note of any discrepancies.

Additional Uses of PFMS Portal Login

PFMS portal login offers more than financial tracking. It supports various other critical administrative functions, enhancing governance efficiency and accuracy.

- Efficient budget preparation

- Timely expenditure control

- Improved transparency in governance

- Faster electronic fund transfers

- Enhanced financial reporting capabilities

These additional uses make the system invaluable for effective financial governance. Regularly using the system ensures better overall resource management and compliance with financial regulations.

Licensed Authorities for Digital Signatures in PFMS Portal Login

Selecting licensed authorities ensures secure and reliable digital transactions. These certified authorities comply with legal standards, ensuring the authenticity and validity of issued certificates.

| Authority Name | Certificate Class | Validity Period |

| Capricorn CA | Class 2, Class 3 | 1-3 Years |

| eMudhra | Class 2, Class 3 | 1-2 Years |

| Sify Technologies | Class 2, Class 3 | 1-3 Years |

Choosing the right authority helps maintain secure financial activities. Authorities provide different certificate types suitable for various financial operations, ensuring robust protection for sensitive financial data.

FAQs

Q1. What if I forget my PFMS portal login password?

Ans. You can reset your password by clicking “Forgot Password” on the login page. Follow the instructions provided to set a new password securely.

Q2. Can multiple users use the same PFMS portal login ID?

Ans. No, each user must have a unique login ID to maintain security and accountability within the system.

Q3. How do I verify my PFMS account?

Ans. After registration, verification instructions will be sent to your registered email address. Follow the provided link to complete verification.

Q4. Is there a support contact for technical issues?

Ans. Yes, technical support is available via email at sales@certificate.digital or by calling 011-614-00-000.

Q5. How often do digital certificates need renewal?

Ans. Digital certificates typically need renewal every 1-3 years, depending on their validity period. Ensure timely renewal to maintain uninterrupted service.

Conclusion

The PFMS portal login significantly streamlines government financial management. It ensures secure, efficient, and transparent handling of public funds. Regular usage of digital signatures and proper registration enhances the security and integrity of all financial transactions conducted via the PFMS system.

Read More Blogs:-)

Leave a Reply