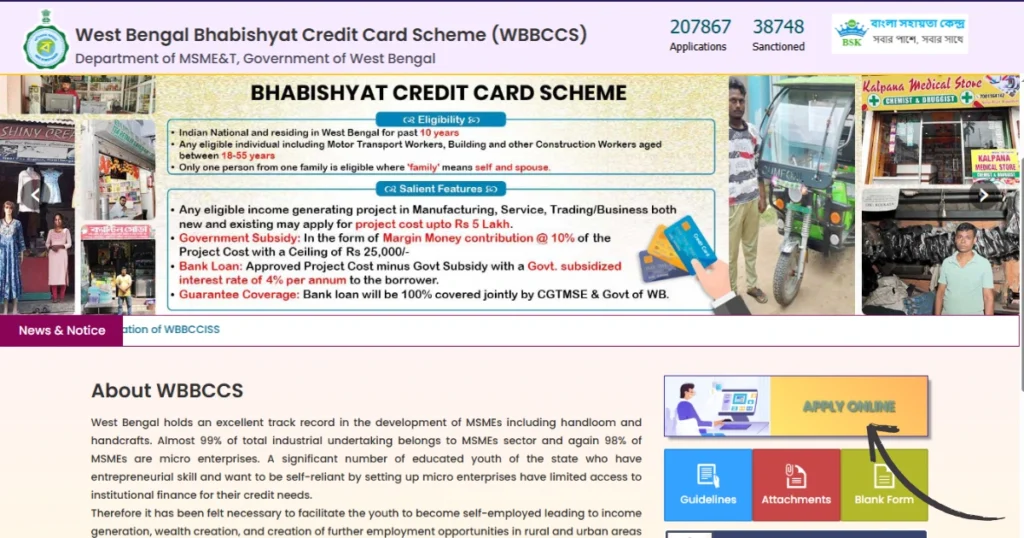

Starting your own venture can feel overwhelming. The hardest part? Funding. To solve this, the West Bengal government has stepped in with the bhabishyat credit card. This isn’t just a loan card—it’s a bridge to financial independence. With backing from the government, this scheme makes it easier for local youth to begin their entrepreneurial journeys. Whether you live in a remote village or a bustling town, this initiative is for everyone who wants to be self-reliant.

The bhabishyat credit card is more than policy—it’s a promise. A promise to create jobs. A promise to uplift families. And a promise to support every dreamer with the tools to succeed. By offering up to ₹5 lakh with government guarantees, this scheme opens the doors to new possibilities.

What is the Bhabishyat Credit Card?

The bhabishyat credit card is a financial tool. It offers credit support to first-time entrepreneurs. It’s part of a larger scheme by the state. The aim is to create jobs and improve self-reliance. It supports both rural and urban youth. You get access to ₹5 lakh without any security. It helps kickstart your business dreams.

A New Push for Local Entrepreneurs

The bhabishyat credit card is designed for small businesses. It targets the micro sector. It includes artisans, handloom weavers, and others. Many lack formal financial help. This scheme gives them a direct route. The goal is to boost job creation and economic activity.

Why the State Launched It?

The bhabishyat credit card was created to support unemployed youth. Many have skills. But they don’t have capital. The scheme connects them with easy credit. The state government backs this credit. So, banks have no risk. Loans are more accessible.

1. Empowering Micro Businesses

West Bengal’s economy is built on small-scale industries. These include local crafts, textiles, and food processing. These businesses need small capital. This card makes that possible. Entrepreneurs can buy machines, raw materials, or rent shops.

2. Supporting Unbanked Citizens

Many rural residents have no banking history. So, they don’t get loans. The bhabishyat credit card removes this barrier. Government guarantees make approval easier. People get access to funding even with no prior credit.

3. Creating Urban and Rural Jobs

The scheme is not just for urban centers. It’s for every village too. New shops, services, and local businesses create employment. The ripple effect lifts entire communities. It helps reduce migration and boosts local income.

Key Features of Bhabishyat Credit Card Scheme

The scheme includes many unique features. These are meant to simplify the loan process.

| Feature | Details |

| Credit Limit | Up to ₹5 lakh per person |

| Collateral | Not required |

| Interest Rate | 4% subsidized annually |

| Age Limit | 18 to 55 years |

| Guarantee | 100% by Govt + CGTMSE |

| Subsidy | ₹25,000 as margin money |

| One per Family | Only one member eligible |

Eligibility Criteria

To apply under the bhabishyat credit card, you must meet some conditions. These ensure only genuine applicants benefit.

- Permanent resident of West Bengal.

- Aged between 18 and 55 years.

- Have lived in the state for 10+ years.

- Only one member per family can apply.

This keeps the process focused and fair.

Documents Required for Application

Get these documents ready before you apply. You’ll need both originals and scanned copies.

| Document | Purpose |

| Aadhaar Card | Identity proof |

| PAN Card | Tax and income proof |

| Domicile Certificate | Residency proof |

| Bank Account Details | Loan disbursal |

| Passport Size Photos | Profile ID |

| Mobile and Email ID | Communication |

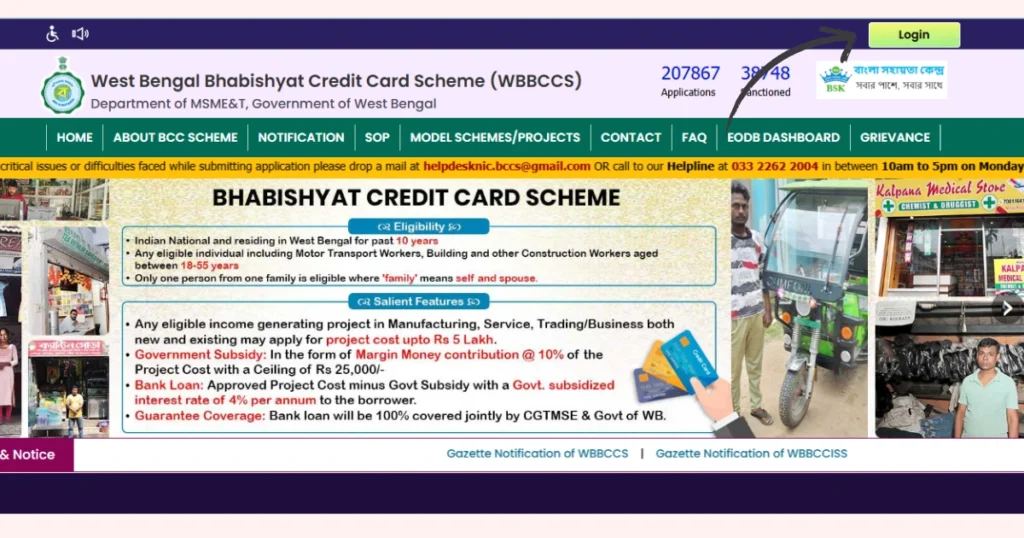

How to Apply for Bhabishyat Credit Card Online?

You can easily apply from your home. Use your phone or computer. Follow the steps listed here:

- Go to the official BCCS portal.

- Click on the Apply Now option.

- Select Register Here.

- Confirm your vocational course (if any).

- Fill in your name, email, and mobile.

- Accept terms and click Register.

Your profile will be created. You can then start filling the full application form.

Logging in to the Portal

Once registered, follow these steps to log in:

- Visit the portal homepage.

- Tap on the Login button at the top

- Enter your registered mobile or email.

- Type your password and CAPTCHA code.

- Hit the Sign In button.

From here, you can track your application status.

Government Support Behind the Scheme

The credit card scheme gets full state support. CGTMSE and WB Govt guarantee the bank loans. This makes banks more confident to lend. Even in case of default, banks are protected. So, the approval process is smoother and faster.

How It Helps the Economy?

- Encourages rural startups

- Promotes self-reliance

- Reduces dependency on external jobs

- Increases bank account ownership

- Enhances women’s participation in business

What is the Vision of This Scheme?

The vision is clear. Empower the youth. Reduce unemployment. Strengthen MSMEs. Help citizens become job creators. Over 2 lakh entrepreneurs are expected to benefit by 2025. It’s a step toward inclusive growth.

Final Thoughts on the Bhabishyat Credit Card Scheme

The bhabishyat credit card is more than a scheme—it’s a movement. It brings opportunity to those who have the talent but not the means. With zero collateral, simple digital steps, and full state support, it puts dreams within reach. For West Bengal’s youth, this could be the turning point.

If you’ve ever wanted to run your own business, now is the time. The bhabishyat credit card gives you a platform to build something real. Something lasting. It doesn’t just offer money—it offers hope. Take that step today. Let the future begin with you.

Common Questions Users Ask

Q1. What is the bhabishyat credit card?

Ans. It is a loan scheme by the West Bengal government. It provides ₹5 lakh loans without collateral.

Q2. Who is eligible for the credit card?

Ans. Anyone aged 18 to 55 from West Bengal who has lived there for 10 years.

Q3. Is the interest really just 4%?

Ans. Yes. The government pays the rest.

Q4. Can I apply again if rejected?

Ans. Yes. But make sure all documents are correct.

Q5. Where can I check my application?

Ans. Log in to the official BCCS website to check your status.

Read Our More Blogs…

Leave a Reply