Government jobs create a dream for multiple candidates throughout India. These roles continue to be popular because they offer stability together with good pay and chance to make positive differences. Regulatory bodies such as IRDAI Grade A together with SEBI Grade A and RBI Grade A etc. have started attracting more candidates applying for government positions.

The following document will guide you through select government professions expected to be in demand for 2025 as well as provide information about IRDAI Grade A and similar highly desirable positions.

Why Are Government Jobs So Popular in India?

The combination of advantages in government positions makes them extremely appealing to job seekers. Some of these include:

- Security at work becomes more stable and longer-lasting when personnel work in positions held by the government sector.

- Government employees can access lucrative compensation packages which provide pension benefits as well as housing benefits and medical health benefits.

- Employed individuals have the advantage of a well-balanced life through rigid work schedules alongside extensive discounted time away from work.

- The prestige value of Indian society attaches itself to government positions particularly those within regulatory bodies.

Future job seekers will find their dream positions in 2025 among the selection of most desirable roles that includes IRDAI Grade A alongside RBI Grade B and SEBI Officer.

IRDAI Grade A has become increasingly popular for its functions.

The insurance sector requires operation oversight which is handled by IRDAI (Insurance Regulatory and Development Authority of India). The establishment of IRDAI (Insurance Regulatory and Development Authority of India) in 1999 positions this regulatory entity as central for insurance industry operation and growth in India. And Grade A officers? IRDAI Grade A functions as the essential core that supports this organization.

I Initially thought the same thoughts about IRDAI Grade A when someone mentioned it to me the first time. After further research I realized that IRDAI Grade A entails much deeper aspects beyond initial appearances. Insurance industry regulation advances to an essential level as IRDAI (Insurance Regulatory and Development Authority of India) works to protect multiple lives through industrial development. The increasing need for insurance in India makes the work of IRDAI Grade A officers vitally essential today.

The reasons why this position stands out in a unique manner are:

- As an employee of IRDAI Grade A you will take on a wide range of responsibilities which include policy execution together with market oversight.

- Working at IRDAI as a Grade A officer provides job stability with high prestige because it associates you with a respected authority in insurance regulation.

- The government sector provides outstanding salary benefits combined with opportunities for professional development and it presents an exceptionally inviting package of perks.

A Glimpse into IRDAI’s Journey

When the establishment of IRDAI began in 1999 it did not establish itself as the powerful entity it currently represents. The Insurance Regulatory and Development Authority of India appeared in 1999 through the Insurance Regulatory and Development Authority Act that occurred after India’s insurance sector became liberalized. Before this time the sector operated without a single regulative system which resulted in various inconsistent procedures. The industry which regulates insurance policies directly impacting life insurance benefits now operates under standardized processes while also emerging as an entity professionally supervised by IRDAI. IRDAI has established itself as an important regulatory body which some compare to RBI and SEBI.

The distinctive features of IRDAI Grade A differentiate it from other positions.

Those Interested in the insurance and financial sectors should consider the IRDAI Grade A role as an excellent professional entry point. The Insurance Regulatory and Development Authority of India (IRDAI) serves both as a regulatory body for insurance operations in India and the promoter of the Indian insurance sector.

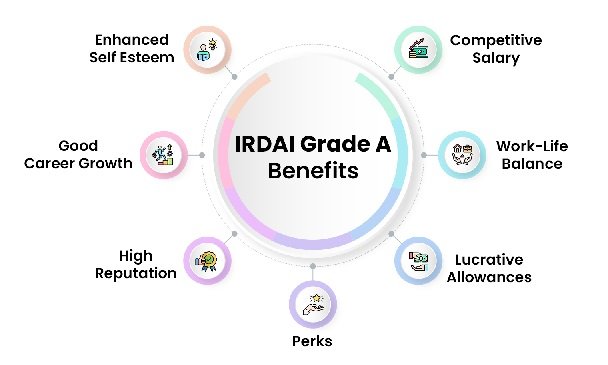

The IRDAI Grade A position offers attractive benefits because of these reasons:

- Employees benefit from attractive compensation offered by this job position. The employment package for Grade A workers at IRDAI involves combination of basic salary with structural allowances along with supplementary benefits.

- In IRDAI Grade A service you exercise authority to conduct regulations and create policies while overseeing the insurance marketplace.

- The career advancement within this position offers visible promotion opportunities along with chances to develop professional competence.

- The employment environment at this institution provides structured daytime hours while maintaining balanced workloads for each employee.

Future applicants aiming for IRDAI Grade A roles can prepare ahead of time since the notification for 2025 has not been declared yet.

IRDAI’s Impact Beyond Policies

The public typically views IRDAI only as a regulatory institution yet its operations directly affect people at different levels. Natural disaster scenes reveal that insurance claims become vital tools for deciding whether people can survive financially or permanently suffer lasting harm. Through its oversight IRDAI enforces companies to uphold their insurance commitments thus providing protection for millions of policyholders.

An example of notable achievement stems from the government-funded Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) insurance scheme. IRDAI exercises regulatory oversight to guarantee direct access of these initiatives for their targeted beneficiaries.

A Quick Look at Other Regulatory Jobs: RBI, SEBI, and More

Jobs with regulatory bodies within the government sector possess distinct positive points. Here’s how they compare:

RBI Grade B Officer:

- The institution controls monetary policy framework together with managing India’s monetary operations.

- The role of RBI Grade B officer includes high compensation alongside subsidized accommodation and access to career advancement programs.

- The functions at IRDAI diverge from RBI and SEBI because they handle banking subjects alongside financial matters without insurance responsibility.

SEBI Grade A Officer:

- The organization acts as a security watchdog to defend investors while regulating securities.

- Perks: Great work environment and financial incentives.

- SEBI maintains responsibility for stock market authority although IRDAI manages insurance operations.

PFRDA Grade A Officer:

- The role of PFRDA Grade A Officer involves pension fund management alongside pension fund regulation.

- Perks: Lucrative salary and retirement benefits.

- Difference from IRDAI: Focuses on retirement schemes.

Such roles which include IRDAI Grade A require specialized understanding to deliver influential careers that reward their holders.

Preparing for IRDAI Grade A and Similar Exams

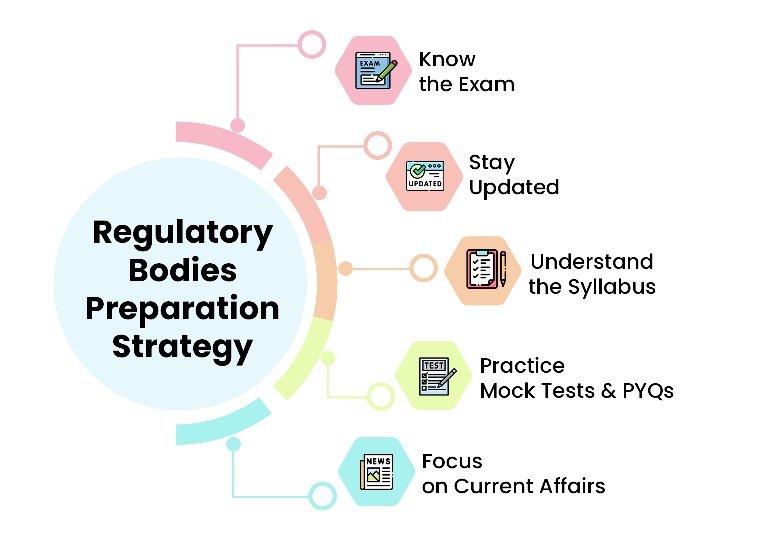

If you’re aiming for a role in regulatory bodies like IRDAI, preparation is key. Here’s a quick guide:

- Understand the Syllabus: The IRDAI Grade A syllabus typically includes subjects like reasoning, English, quantitative aptitude, and industry-specific topics like insurance and financial regulations.

- Stay Updated: Regularly check for the IRDAI Grade A Notification to know about important dates and exam details.

- Practice Mock Tests: Solving previous years’ papers can help you understand the exam pattern and improve time management.

- Focus on Current Affairs: Roles like IRDAI Grade A require knowledge of current events in the insurance and finance sectors.

By following a structured preparation plan, you can increase your chances of success.

The Future of Government Jobs

As India’s economy grows, the demand for skilled professionals in regulatory bodies will rise. The government’s focus on digitization, financial inclusion, and economic stability creates numerous opportunities for aspiring candidates.

While IRDAI Grade A is a fantastic option, don’t limit yourself. Government jobs in India are diverse, and exploring multiple avenues increases your chances of success.

For example:

- IRDAI: With the insurance sector expanding, the role of IRDAI Grade A officers is becoming more critical.

- RBI and SEBI: These bodies ensure a stable financial ecosystem.

- State-Level Government Exams: Explore state-specific government roles for localized opportunities and responsibilities.

- Job Portals: Regularly check official sites and trusted portals for updates on roles like IRDAI Grade A, RBI, and SEBI.

Such jobs not only offer personal career growth but also allow individuals to contribute to national development.

Why Start Preparing Now?

The notice regarding IRDAI Grade A 2025 recruitment is anticipated to be released shortly. Planning now provides substantial benefits because the examination notification is drawing near. A correct understanding of IRDAI Grade A syllabus alongside its examination pattern lets you design an effective study plan for yourself.

The entire process of preparing for a regulatory exam typically includes common content with other equivalent examinations. Preparation for IRDAI Grade A also provides advantages for exams such as RBI Grade A and SEBI Grade A.

Conclusion

The regulatory bodies IRDAI and RBI alongside SEBI are among the government institutions that provide outstanding career potential for 2025. Many potential candidates choose the IRDAI Grade A role because it provides both outstanding compensation and comprehensive career development together with meaningful contribution to society.

The thoughts of government jobs recall moments from childhood when I used to dream about positions that create genuine positive change. The transformation of aspirants’ dreams into real careers through Regulation bodies and other government outlets continues to serve numerous candidates every year.

The time has arrived for you to begin your journey. Strategize your studies from right now because you could develop into one of the IRDAI Grade A officers who molds the insurance sector of India’s future.